|

|

The Move Up (Crossover) to $20

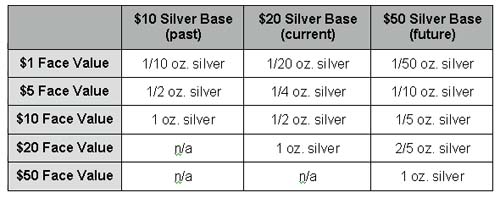

The Move Up (previously "Crossover") to the new $20 Silver Base was explained in these six articles published in the monthly newsletter: Liberty Dollar News: Liberty Dollar Moved Up to the $20 Silver Base on Thanksgiving Day, Thursday, November 24, 2005. Click HERE for the complete story. The history leading up to the Move up is below. On Friday, March 19, silver crossed over $7.50USD and the phones started ringing. "Silver is over $7.50!!! Have we switched over to the $20 Silver Base? Have you DOUBLED the face value of the Liberty Dollar?" Seems that "everybody knows" that the currency was to be revalued at $7.50. And is often the case, what "everybody knows" is wrong. Just because silver is over $7.50, the Liberty Dollar has not been re-valued. What? Why not?!  For the record: The "Crossover Point" for the Liberty Dollar from the current $10 Silver Base (one Troy ounce of .999 fine silver backs $10 Liberty Dollars) to the new $20 Silver Base (one Troy ounce of .999 fine silver backs $20 Liberty Dollars) will occur when silver's thirty day moving average stays over $7.50 for thirty consecutive calendar days. So although silver went over $7.50USD on Friday, March 19, which is a strong indicator that we are nearing the Crossover Point, that was only the first day to contribute to the thirty day moving average (30DMA) of $7.50. But silver does not have to be over $7.50 for 30 days in a row to move the 30DMA above $7.50. In fact, since every day influences the average, a big jump or many large movements in the spot can move the average rather quickly. Note the change of the 30DMA from March 19 to March 26 below! But these changes are not as it appears to be. If you were watching the silver market on March 19, 2004, you may know that silver hit $7.69 on the New York Commodity Exchange (COMEX), but the 30DMA is based on the close, not the high or inter-day quotes. As the Crossover Point is so important, the Liberty Dollar will use an independent, third party source for its 30DMA so there is no doubt. Just like the monthly audits, there is no secrecy. You can follow the development by simply going to Kitco. The 30DMA can be viewed, printed and saved via: http://www.kitco.com/reports/. Click on Gold & Silver Market Watch (look for the red tab for ScotiaMocotta and select date). The 30DMA is listed at the bottom of page 2. If you are not familiar with the Mocatta name, they date from the early 1600s and were one of the founding members of the Bank of England in 1694. Mocatta is now part of ScotiaMocatta, which is a division of the Bank of Nova Scotia, a Canadian Bank. Their 30DMA is based on silver prices from the London Metals Exchange (LME), which is different from the New York Commodity Exchange (COMEX). For example, on Friday, March 19, 2004, silver closed at $7.63 on COMEX and $7.55 on LME. Also on the same site, you will find Market and Technical Commentary plus 4, 7, 9, 14, 18, 30, 60, 100, 200 and 400-day moving averages. On Friday, March 19, the 30DMA was $6.62. Only a week later, on Friday, March 26, it was $7.01. At this rate the 30DMA could be $7.50 or over in less than 30 days! Please check the 30DMA often and get ready for the most exciting part of the Liberty Dollar model, when our "free market currency" doubles in value as it must because that is the nature of a "free market currency". As I said many years ago, one of the main reasons that the Federal Reserve has been able to survive for so long is because without a competing currency, there has been no way to really demonstrate how terrible "their" currency has under-performed and fleeced the American people. Now, with the US dollar sinking and the silver currency soaring, the Liberty Dollar provides the wake-up call for Americans to get out of the USD and bring an end to the current manipulated monetary system. Either change your money or lose your value: that is the choice that faces Americans today. Please share the Liberty Dollar with someone you love. And get as many Liberty Dollars as possible. April 2004: Shot Across the Bow - 30DMA SummaryNope, the Liberty Dollar didn't double. It didn't move to the $20 Silver Base but it sent a 'shot across the bow' of things to come. In more rapid fashion that I would have thought, silver's 30 Day Moving Average (30DMA) rocketed past the $7.50 mark and stayed over $7.50 for eight days! Amazingly, silver hit $8.63! And then retreated to a fantastic buying opportunity range from $5.50 to $6.00. And although there was a lot of interest in the Liberty Dollar doubling, as the Monetary Architect of the currency, I am particularly pleased that the "Crossover Point" was not met the first time because this confirms the soundness of its design. In my view, the 30DMA worked as intended. It's good the currency did not zoom so easily to the new $20 Silver Base. The Move Up (Crossover) Point was specifically designed to be difficult to attain, because the silver market is a study in volatility. One of the main problems encountered in designing the market driven Liberty Dollar was how to accommodate for silver's free-market behavior. The answer was (1) to develop the Silver Base and tie it to the currency's face value, and (2) to tie the Crossover Point to silver's 30DMA staying over $7.50 for thirty consecutive calendar days. At that point the $10 Silver Base (one Troy ounce of .999 fine silver backs $10 Liberty Dollars) would crossover to the new $20 Silver Base (one Troy ounce of .999 fine silver backs $20 Liberty Dollars) thereby providing a working model of an inflation proof currency - owned by the people. As the Crossover Point is very important, the Liberty Dollar uses an independent, third party source for its 30DMA so there is a definitive point that is readily available and easily verifiable by everyone. Just like the monthly audits, there is total transparency for the econometric stability-inducing features of the Liberty Dollar to protect it from the erratic actions of a free silver market. You can follow the 30DMA and watch it develop by simply going to ScotiaMocotta at http://www.scotiamocatta.com/prec/pdfs/pm_daily.pdf. The 30DMA silver is at the bottom of page two. To summarize: The Move Up started on Friday, March 19, when silver crossed over $7.50 per ounce. On April 14 the 30DMA crossed over $7.50 for the first time - to $7.506. That was day one of the thirty consecutive calendar days. On April 22 the 30DMA dropped to $7.467. It stayed over $7.50 for eight days, i.e. over a quarter of the required time. Next time it could be for real… Got a keen interest in silver? I would recommend you review Ted Butler's work. If there is anyone who is more enthusiastic about silver than I am, it would be Ted Butler. Silver holds an enormous potential for you to profit and resolve our country's looming monetary crisis. A simple search on Ted's name will get you to many sites or review his archives at http://www.butlerresearch.com/archive_free.html. Another excellent source of information is David Morgan, a fellow Liberty Associate and 'Silver Guru' who agrees that silver holds an incredible potential for our country. "That is why I became a Liberty Associate. I like the Liberty Dollar because it makes economic sense and using it is the right action for our country. We need a currency backed by real substance, backed by gold and silver. Real value for real Americans." David contributed a chapter on silver to "The Liberty Dollar SOLUTION to the Federal Reserve" book on inflationary currency. David publishes "Silver Investor" an outstanding monthly newsletter that is available at http://www.silver-investor.com. So is this doubling a bunch of hype? Not really, it is just classical value economics at work. The Liberty Dollar is simply responding to the market. Just as gasoline and silver has doubled from $4 to over $8 per ounce, now the Liberty Dollar is also set to double. As the underlying commodity (silver) doubles, the Liberty Dollar must double. Thereby exemplifying a truly 'inflation proof currency' that is the essence of a free market currency. And the best part is that everybody can participate. And should! Everybody can profit as Americans begins the arduous process to return our monetary system to value. Doesn't it just make sense to use a currency that not only reflects the current market prices but one that you can use at a profit? So get ready for the most exciting part of the Liberty Economy. As the US dollar continues to fall, commodity prices rise, and the price of silver rebounds from a half-century of manipulation, the face value of the Liberty Dollar will rise dramatically in sync with silver. It is the solution to rampant fiat government currency. Please take ACTION. Get as many Liberty Dollars as possible before the base doubles. Your family's financial life might depend on it! October 2004: Question of the MonthQUESTION: What is the effect if the 30-day moving average falls below $7.50 after everyone has exchanged $10 LD for $20 LD? I don't see the 30DMA to be a one-way valve and am concerned that it could tread back-and-forth across that $7.50 line, meaning in theory that the LD could keep switching between a $10 and $20 silver base. ANSWER: It is most unlikely, if not impossible, for silver valued in US dollars to retreat after crossing over its fordable ecometric barrier of "30-day moving average over $7.50 for 30 consecutive calendar days". But as this concern has been raised, please consider the simple logic that with the world "reserve" currency exploding, i.e. inflating at an alarming rate, the cost of silver recovery increasing, and the simple fact that even the slaves in Mexico and Peru's silver mines must be fed or there won't be any new silver, that the cost to get silver out of the ground cannot go down. The US dollar cannot increase in value because it is based on the foul hot air of politicians. And with digital photography quickly replacing silver film, above grade recovery is quickly declining, as photography is the only meaningful source for existing silver. In reality, only after a global monetary collapse, will a new silver price structure evolve and hopefully that will also include a new value backed currency similar to the Liberty Dollar model. Of course, this outcome has yet to be decided by the marketplace. But by that time, many fortunes will have been lost and only a few well-prepared individuals will have profited. First, there are no one-way valves in a free market. So what will prevent the Liberty Dollar from being whipsawed by a fickle silver market? The ecometric barrier designed into the Liberty Dollar model is three times longer when silver is moving down than on the upside and a dollar less to give the market every advantage to stabilize itself. In other words, the 30-day moving average of silver must stay BELOW $6.50 for 90 consecutive days to warrant any consideration of the currency returning to the $10 Silver Base. Remember, a study of silver is a study in volatility. Silver has a history or "profile" that soars and then falls. That profile and the introduction of the "time factor" was the basis for the ecometric tools that govern the Liberty Dollar - the world's first free market currency. Under no circumstances will the Liberty Dollar "keep switching between a $10 and $20 Silver Base" because "time" is an integral part of the design of the new currency. There is a huge difference between the spot price and the DMA price. That difference is the time factor. A thorough study of the silver market is most valuable in understanding the complexities of the Liberty Dollar model and the value it will bring to the massive monetary events that we are about to experience. Be it an orderly transition or global meltdown, silver will provide the best protection and profit while the Liberty Dollar proves itself to be a superior currency model, if we are to return to "just weights and measure" once again. We chose, therefore we are free. Monday, November 15, 2004ALERT: Silver advances. Liberty Dollar set to double? Silver was under $6 per ounce during most of June, 2004. It moved to over $6 during July. By the time I posted on August 20th silver, it had already advanced to $6.85. On August 20th, we posted the "Summer slows/Summer lows" article about low silver prices. We said, "…the 'summer lows' … [have] historically have been the best time to buy … gold and silver … Liberty Dollars." Very few responded. In the August Newsletter we lamented, "…unfortunately, people don't like to buy when the price is low. No, they always look for a sure thing. And that sure thing is always bought at a higher price." Again, very few responded. Last Friday, November 12. 2004, less than three months after August, silver closed at $7.58. The 30-Day Moving Average was $7.22, right behind the spot price, which represents an extremely strong base. Wake up! The US Dollar is sliding into a pit. You are going to wake up poorer than when you went to sleep. Please take action. Please don't follow the German example after the First World War. Silver is a terrific buy! The Liberty Dollar is entering the slot to DOUBLE. Please protect yourself and your money, NOW. Your choice, like it or not, is either: Change your money - or lose it. Which will it be? Find out about the Liberty Dollar potential now: CALL: 888.421.6181. This ALERT was followed by two articles in the Liberty Dollar News: LIBERTY DOLLAR NEWS: December 2004 Vol. 6 No. 12Liberty Dollar Did Not Crossover On December 6, the 30 day moving average (30DMA) crossed over $7.50 and the Liberty Dollar moved into the 30 day slot to crossover for the second time to the new $20 Silver Base and double in face value. On December 9, after only three quick days, the 30DMA dropped below $7.50 and for the second time, the Liberty Dollar did not double. Other than acknowledging that the ecometric features designed into the currency performed exactly as planned (note March and April newsletter for specific details), there are two noteworthy points. First, on November 12, the first day that spot silver was over $7.50, the 30DMA was already $7.22! This was dynamically different than when the Liberty Dollar first tried to Move Up in April and failed after eight days. The fact that the 30DMA was trailing so close to the spot price was evidence of the enormous base that silver had built since April 2004 (when the Liberty Dollar tried to crossover the first time). So market judgment indicated that this time the crossover was more likely to happen. But it did not happen. Why did silver collapse? That is the second noteworthy point and the subject of the following article. Suffice it to say, it is the unplanned free market that demands a disciplined currency because no one, and most certainly not the government, will ever know what any one person will do. Please read the following article to understand why silver collapsed and why the Liberty Dollar is designed as it is - to bar it from such unexpected events. The article above was followed by the article below in the same Newsletter: Why Did Silver Collapse?Everything has a reason, or so reason seems to dictate. Its man's quest to find that reason. So it was quite natural to ask, "Why did silver collapse?" First a few particulars and then the answer according to this writer. The silver market, although quite important to thousands of users, millions of people, and the Liberty Dollar, it is in all reality a very small market. In comparison to the New York Stock Exchange it not even a days worth of volume. Compared to gold, it does not measure up in price or verse and is usually relegated to being the 'poor man's gold'. In all reality silver moves sympathetically with gold and there lies the key to understanding why the 30 DMA of silver collapsed and the Liberty Dollar did not Move Up to the new $20 Silver Base. It is important to note that it was not just the silver market that dropped so noticeably. Gold dropped too. So to understand what happened to derail these well-established markets, we have to look at the big figures even though both the gold and silver markets have small volume. We need to think in millions of dollars and "metric tons". A metric ton is 1,000 kilograms. A kilogram is about 2.2 pounds, so a metric ton is about 200 pounds heavier than our regular avoirdupois ton. And as a Troy ounce (unit of weight for precious metals) is 31.15 gram, a kilogram is about 32.15 Troy ounces. So a metric ton is also 32,150 Troy ounces. Now on December 6, the price of gold was $453.30 and silver was $7.90. Two days later, on December 8, gold dropped to $436.80 and silver plummeted to $7.08. The metals continued to drift down and closed the week at $433.40 and $6.68, gold losing 3-1/2% and silver over 15%! What could have possibly torpedoed the market? Enter the bad guys and the world's largest gold fund that was launched on November 18, 2004 just two weeks before this wipeout. The fund, StreetTracks Gold Shares was started by the major bullion banks, many of the same guys who are rumored to own the Federal Reserve: including JP Morgan Chase Bank, ScotiaMocatta, Deutsche Bank AG, HSBC Bank USA, and UBS AG. Operating in plain sight under the old edict 'I stole it - it is mine' they can be found at http://www.streettracksgoldshares.com. Now on December 6, Gold Shares' inventory stood at 103.56 metric tonnes. That is whopping 3,329,454 Troy ounces of pure gold! On December 7, their inventory dropped to 88.02 metric tonnes. That is a drop of 15.54 metric tonnes, or an unbelievable 15% of their inventory with a street value of over $1,503,043,000 with gold at $451.50 on December 7th, day it was sold! Over $1.5 billion in one day! A drop of 15 percent!? Obviously, someone on the inside wanted their gold and they didn't give a damn about the market. Or did they? It would appear that they wanted cash (dollars or euros) vs. gold and they wanted it NOW... before the New Year. And they got it! Remember even Warren Buffet, with all of his billions, couldn't get delivery of all of his 130 million ounces of silver. We are talking about 15.54 metric tonnes … 3.3 million ounces of 9999 fine gold or $1.5 billion USD delivered in one day! Hummm… Who do you think could command such power over the fund that is owned by the largest, meanest banksters in the world? Just think, who in the world has not just that kind of money? Who's got that kind of pull? Could it be the Rothschilds? Could this be the result of them "getting out of the gold (public) market"? After all, there is nothing more private than precious metals and the Rothschilds... Back in the April issue of the Liberty Dollar News, we featured an article: "Rothschild to pull out of gold market after 200 years" by James Moore for the Daily Telegraph. Registration interestingly dated on April 15. 2004. We titled our article with the question: "Rothschilds Quitting the Gold Market?" and I asked, 'Who bought all the gold that the Bank of England sold a few years ago?' Who has "all the money in the world"? Who has consistently been ahead of the monetary curve and would have insider knowledge that the world's economic system was going to tank. And who wanted to profit from all that gold, but couldn't because their gold was in the Bank of England? None other than the Rothschilds." There is no doubt that, whoever got the 15.54 tonnes of gold worth $1.5 billion, collapsed the market. Dumb? Definitely not, because as any well seasoned trader knows, this presented not only an enormous amount of money, it also provided a gigantic buying opportunity to step back in and buy even more gold at greatly depressed prices… But wait, we are talking about the best metal traders in the world. We are talking about NM Rothschild that was founded in 1810 by Nathan Mayer Rothschild. The same company that has chaired the London Bullion Exchange right in their own office, and "fixed" the world gold price twice a day since it was incorporated in 1919. Why buy milk when a cow is cheap? Any smart trader would not buy gold, they would buy cheap silver, down 15%! After all silver moves sympathetically with gold. It was bound to collapse because the silver market is even smaller than gold and is much more volatile. Silver provides a much better buy… for Rothschild and us! As Simon Weeks, chairman of the London Bullion Market Association, said about Rothschild, "It is very sad to lose such a long-established member of the gold market but we have lost participants before, such as Credit Suisse, and the market will continue." Long established member, indeed! It was Rothschild and Mocatta, who date back to the founding of the Bank of London in 1694, that started the London bullion market! I don't think anyone with 15.54 metric tonnes of gold (or maybe over 1,000 metric tonnes of silver!) could possibly be considered 'out of the gold (silver) market'. Is Credit Suisse out of the gold market? No, nor is Rothschild. They just 'pulled out' of the 'public' trading of gold to make more money, privately. As I concluded in the April article: Oh, those poor (Rothschild) guys! As all markets have become more 'democratic' with the rise of the Internet and as GATA raises the consciousness about the manipulation in the metals market, I think Rothschild simply decided to play it safe with their gold and "pull out". In this regard, I think we should take a lesson from the shrewd old Rothschilds and 'pull out' our money and get into Liberty Dollars ASAP. StreetTRACKS Gold Shares can be found at: The direct link to their gold inventory is: http://www.streettracksgoldshares.com/us/value/gb_value_usa.php#2 Bernard von NotHaus Please read the monthly newsletter for all the latest info on the Liberty Dollar and archived at http://www.libertydollar.org/ld/information/newsletter.htm. |