|

|

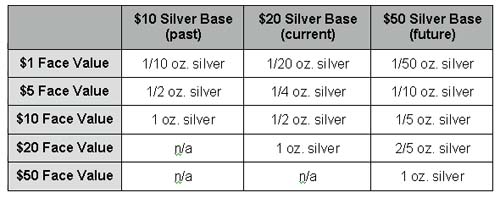

Liberty Dollar DOUBLES Doesn't it just make sense that when the underlying commodity that backs the currency increases in value, shouldn't the purchasing power of that currency also increase in value? Of course. And isn't that the essence of an inflation proof currency? Absolutely! In fact, when you think about it, the only way the Liberty Dollar can accommodate higher commodity prices is to increase its Face Value. And that is why the ALD Moved Up to the $20 Silver Base on Thanksgiving Day, Thursday, November 24, 2005.  Since "inflation" has existed for our whole lives, most people simply take inflation as a fact of life. But for an increasing number of people, inflation is known for the theft that it is. For these concerned Americans, there is no doubt that we should have an "inflation proof" currency. The US Constitution mandates a value based money. The Bible commands us to have "just weights and measures." Thinking consumers know the effects of inflation and try to protect themselves from its curse. Unfortunately, inflation has been around so long - three generations - that many people, including "leaned economists," don't realize that the United States did not have inflation before the Federal Reserve was created by Congress in 1913. Imagine that! No inflation. No need to worry about protecting your money, your investments, your retirement from the depreciating government money. Thankfully inflation is now known as a crime, an evil, cast upon our great country and your money. Inflation is theft. From the very beginning, the Liberty Dollar was designed to be "inflation proof" to protect your money at a profit! One of the most difficult parts in developing the Liberty Dollar was how to design a currency that was based on precious metals that changed every day, often every minute, and spiked upward unexpectedly. Not only did the Liberty Dollar need to accommodate intraday trading, but also how does such a "free market currency" accommodate greatly increased prices? For as certainly as the government will continue to inflate the paper money supply, the precious metals will respond and increase in US Dollars value. The answer to intraday trading was quite simple with a pricing formula that was based upon the current spot price of gold and silver. The Liberty Associate discounted rate is posted on the web site every day at www.LibertyDollar.org and to accommodate intraday fluctuations, it is updated automatically every hour. The answer to designing a market sensitive currency to accommodate wild swings and spikes in gold and silver prices was much more difficult. Finally it was solved by establishing "Bases" for the currency that mirrored the denominations of the Federal Reserve Notes with disciplined econometric timing features. When the Liberty Dollar was introduced on October 1, 1998, the initial $10 Silver Base was established at one Troy ounce of .999 fine silver. In other words, every ten Liberty Dollars, regardless of its denomination, was backed by one ounce of fine silver. Of course, many people were worried about what would happen to the Liberty Dollar when the spot price of silver went over $10 per ounce. In reply to this concern we published: "What happens to the American Liberty Currency when silver rises over $10.00 per ounce?" Now available at: http://www.libertydollar.org/ld/faqs/silver-over-ten.htm. In that initial statement, we stated that, "When the price of silver rises near $10 per ounce, a new $20 Warehouse Receipt series will be issued. All new Certificates will be identified with "$20 Silver Base." The new $20 denomination certificate will be backed by one ounce of .999 silver, the $10 certificate will be backed by 1/2 oz., $5 by 1/4 oz. and the $1 by 1/20 ounce of silver." In the monthly newsletter, Liberty Dollar News, for March 2005 we defined the econometric features of the crossover point when the Liberty Dollar would Move Up to the $20 Silver Base: "The Crossover Point for the Liberty Dollar from the current $10 Silver Base (one Troy ounce of .999 fine silver backs $10 Liberty Dollars) to the new $20 Silver Base (one Troy ounce of .999 fine silver backs $20 Liberty Dollars) will occur when thirty day moving average (30 DMA) for silver stays over $7.50 for thirty consecutive calendar days." Available at: http://www.libertydollar.org/ld/faqs/crossover-twenty.htm. As the Moveup Point is very important, the Liberty Dollar uses an independent, third party source for its 30 DMA so there is a definitive point that is readily available and easily verifiable by everyone. Just like the monthly audits, there is total transparency for this econometric stability-inducing feature of the Liberty Dollar to protect it from the erratic actions of a free market silver. You can follow the 30 DMA and watch it develop by simply going to ScotiaMocotta, which is a division of the Bank of Nova Scotia, a Canadian Bank, at: http://www.scotiamocatta.com/prec/pdfs/pm_daily.pdf. The 30 DMA is listed at the bottom of page 3. On April 14, 2004, the 30 DMA for silver crossed over $7.50 for the first time - to $7.506. That was day one of the 30 consecutive calendar days. Amazingly, the silver spot price hit $8.63! It stayed over $7.50 for eight days when on April 22 the 30 DMA dropped to $7.467. So the Liberty Dollar did not Move Up. The disciplined model worked the way it was designed to work. The econometric stability-inducing features of the Liberty Dollar protected it from the erratic actions of a free market silver. Then as reported in the Liberty Dollar News for December 2004, "On December 6, the 30 DMA crossed over $7.50 and the Liberty Dollar moved into the 30 day slot to Move Up to the new $20 Silver Base and double in face value for the second time." On December 9, after only three quick days, the 30 DMA dropped below $7.50 and the Liberty Dollar did not double. Again the disciplined currency worked as designed. For a quick understanding as to "Why Did Silver Collapse" so quickly, please read the last article at: http://www.libertydollar.org/ld/faqs/crossover-twenty.htm. The study of silver is a study in volatility. As with every commodity, silver has a history or "profile" that soars and then falls upon demand in the all-important marketplace. A careful study of that profile and the introduction of "time" as a factor is the basis for the econometric tools that govern the Liberty Dollar - the world's first free market currency - that actually responds to the peoples' action in the marketplace. Shouldn't the people who use the currency govern the currency? Isn't that the tenet in Adam Smith's work in The Wealth of Nations? When we each do what is best for ourselves that contributes to and establishes the "common good." No place is this tenet more evident than in the marketplace. And no place is it more important than with our money. Just remember there is a huge difference between the daily spot price and the 30 DMA price. That difference, the time factor, is an integral part of the currency's design. Finally, the third time was the charm. As reported in an ALERT to the Liberty Dollar News, sent on October 25, 2005, the 30 DMA for silver moved over $7.50, and the Liberty Dollar entered the 30 consecutive calendar day slot to Moveup to the $20 Silver Base, which is considered to be the second most important event after the actual introduction of the currency since 1998. The November 2005 issue of the Liberty Dollar News, announced: "Finally after seven years and two earlier tries to move from the entry level $10 Silver Base, rather serendipitously, the Liberty Dollar Moved Up to the $20 Silver Base on Thanksgiving Day, Thursday, November 24, 2005. We were deliriously happy and hope you are too." The complete Newsletter article is available at: http://www.libertydollar.org/information/nlfiles/2005V7N11.pdf. Immediately all Liberty Dollars, in specie, paper and digital forms DOUBLED. If you had Liberty Dollars before the Move Up you profited because the underlying commodity increased in value. If you had digital, your eLD doubled the next day. If you had paper Silver Certificates, you could redeem them for the new $20 Silver Libertys. If you had Silver Liberty in specie form, you were offered a special re-minting rate to exchange them for new $20 Silver Libertys. And although the National Fulfillment Office was swamped, which delayed shipments, the Move Up of the world's first free market currency was a very successful event and marked the birth of the Liberty Dollar. For complete info on the Move Up, please visit: http://www.libertydollar.org/ld/faqs/crossover-twenty.htm. Now, while many people decry the loss of their purchasing power and note "higher" gas and food prices, many more Americans are doing something to preserve their purchasing power. An increasing number of Americans have actually gotten ahead of the "inflation" scam with the new $20 Silver Base Liberty Dollar. You must be ahead of inflation to profit, and that is exactly what the Liberty Dollar has done. Over time, silver will rise more, and the Liberty Dollar will Move Up to the $50, $100, and beyond as it is designed to always keep you ahead of inflation and preserve your purchasing power. But wait! I contend we do not have inflation. I can remember over 50 years ago that I could buy four gallons of gasoline for a dollar. At that time the dollar was backed by silver. And that same amount of silver will still buy four gallons of gas today! That just proves silver money holds its value. As a matter of fact, when you think about it, you realize that gas, food, and almost everything else has NOT gotten more expensive. It only seems that way because the value of the green paper money is worth less so it takes a lot more of it to buy the same thing. We do not have inflation that the government's economic whores would have us believe. We have theft of our purchasing power. Clear and simple theft of our purchasing power! There is NO INFLATION! It is THEFT. Please don't be deceived by the spin put out by the government's economic whores. Please acknowledge the theft and protect your all-important purchasing power by using the Liberty Dollar - already America's second most popular currency. Trust me! Either change your money - or lose it. You must protect the purchasing power of your money because the government can't. They don't have any real money! |